How to Financially Plan and Build a House

Building a house is a significant financial undertaking that requires careful planning and budgeting. Here are some essential aspects to consider when financially planning to build a house:

1. Determine Your Budget

Start by determining your budget for the project. This includes the cost of land, construction materials, labor, permits, and other expenses. Consider your income, savings, and any available financing options. Get pre-approved for a mortgage to know your borrowing limit and interest rates.

2. Secure Financing

Once you have a budget, secure financing for the project. Explore different mortgage options, compare interest rates and terms, and choose a lender that meets your needs. Consider using a construction loan specifically designed for homebuilding projects.

3. Choose a Lot

Selecting the right lot is crucial for your home's value and long-term enjoyment. Research different locations, consider factors like neighborhood, amenities, and proximity to work and schools. Factor in the cost of land, utilities, and any necessary site preparation.

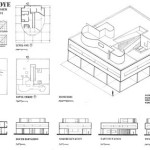

4. Design the House

Work with an architect or home designer to create a house plan that meets your needs and budget. Consider the number of bedrooms, bathrooms, and living spaces required. Get estimates for the construction costs based on the design and materials used.

5. Get Permits and Approvals

Obtain the necessary building permits and approvals from local authorities. This involves submitting plans, paying fees, and ensuring the project meets building codes. The permit process can take time, so factor it into your timeline.

6. Hire a Contractor

Choose a qualified contractor with experience in residential construction. Get multiple bids, compare proposals, and check references. Establish a clear contract outlining the scope of work, payment schedule, and completion dates.

7. Manage the Construction Process

Monitor the construction progress and stay informed about any changes or delays. Attend site meetings regularly, review invoices, and ensure the project is on track and within budget. Communicate effectively with your contractor and address any concerns promptly.

8. Finalize Costs and Payments

As the project nears completion, finalize the total costs and arrange for the final payment. This may involve a final inspection, walkthrough, and closing documents. Ensure all expenses are accounted for and payments are made in accordance with the agreed-upon terms.

9. Move In and Enjoy Your New Home

Once the construction is complete, it's time to move in and enjoy your new home. Don't forget to factor in ongoing expenses such as property taxes, insurance, and maintenance costs.

Building a house is a complex and rewarding process. By carefully planning and managing the financial aspects, you can ensure a successful project that aligns with your budget and long-term goals.

Do You Know How To Build A Financial Home

Financial Planner Is Like An Architect Kclau Com

Building A Financial Plan Without Blueprint Zoe

Construction Budget Template Spreadsheet Com Templates

How Much Does It Cost To Build A House Ramsey

Est Ways To Build A House 10 Tips Rocket Mortgage

How Much Does It Cost To Build A House 2024 Edition

Checklist For Building A Home On Your Farm Includes The People And Team You Will Work With Things Nee House Construction Process

Building A House Vs Which Is Better Rocket Mortgage

How To Build A Home 12 Step Guide Bhhs Fox Roach