Essential Considerations for Estate Home Plans Exceeding 12,000 Sq Ft

Estate homes spanning over 12,000 square feet pose unique challenges and considerations when it comes to planning and executing an estate plan. These sprawling properties require meticulous attention to detail and a comprehensive understanding of legal complexities to ensure a seamless transfer of ownership and preservation of family legacy.

1. Comprehensive Property Inventory:

Creating an exhaustive inventory of all assets associated with the estate is paramount. This includes not only the main residence but also ancillary structures, outbuildings, landscaping, and other improvements. Detailed documentation with photographs, appraisals, and maintenance records is crucial for accurate valuation and proper distribution.

2. Family Governance Structure:

Families with large estate homes often find it beneficial to establish a formal governance structure. This could involve forming a limited liability company (LLC) or trust to manage the property and other assets. Such structures provide legal protection, facilitate decision-making, and ensure continuity of ownership.

3. Asset Protection and Tax Planning:

Estate taxes can significantly impact the transfer of valuable assets. Estate home plans should incorporate strategies to minimize tax liability, such as leveraging trusts, charitable donations, and life insurance policies. Consulting with a qualified estate attorney is essential to explore tax-efficient options.

4. Property Management and Maintenance:

Maintaining a 12,000 square foot estate home requires substantial financial and operational resources. The estate plan should address ongoing costs, repairs, insurance coverage, and the appointment of a property manager to oversee daily operations and ensure proper upkeep.

5. Legacy Planning and Family Harmony:

Estate homes often carry significant sentimental value and serve as a focal point for family gatherings. The estate plan should prioritize preserving the property's legacy while balancing the needs and wishes of all beneficiaries. Establishing clear guidelines for use, inheritance, and potential sale can help prevent disputes and maintain family harmony.

6. Succession Planning:

Succession planning is crucial for ensuring the smooth and efficient transfer of ownership upon the death of the property owner. Wills and trusts should be drafted with precision, addressing specific provisions for the inheritance of the estate home and associated assets.

7. Lifetime Gifting and Estate Planning:

Strategic lifetime gifting can reduce the overall estate tax burden. By transferring ownership of assets, such as portions of the estate home, to beneficiaries during the owner's lifetime, it is possible to minimize future tax implications.

Conclusion:

Estate home plans for properties exceeding 12,000 square feet require careful planning and consideration. By addressing the essential aspects outlined above, families can ensure the preservation of their valuable assets, minimize tax liability, and safeguard the legacy of their estate homes for generations to come.

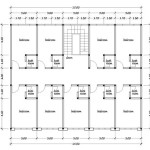

Floor Plans 6001 10000 Square Feet

Plan 012h 0080 The House

The American Man Ion 12 000 Square Foot Waterfront Mansion In C Gables Fl Floor Plans

The American Man Ion 12 000 Square Foot European Inspired Brick Mansion In St Louis Mo

12 000 Sq Ft Luxury N House Design Colonial Style

12 000 Square Foot Bloomfield Hills Mansion Ideal For Entertaining

The American Man Ion 12 000 Square Foot Georgian Colonial Mansion In Greenwich Ct Floor Plans

Castle Luxury House Plans Manors Caux And Palaces In European Period Styles

The American Man Ion 12 000 Square Foot Georgian Colonial Mansion In Purchase Ny Floor Plans

12 000 Square Foot Modern Farmhouse Style Home In Westport Connecticut Homes Of The Rich