Off-the-Plan Houses Sydney: Essential Considerations

Purchasing an off-the-plan house in Sydney can be an exciting and rewarding investment. However, it's crucial to approach this decision with a well-informed understanding of the process and associated considerations. This article delves into the essential aspects of off-the-plan houses in Sydney to help you navigate the journey effectively.

Understanding Off-the-Plan Purchases

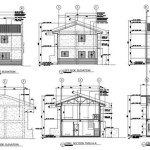

Off-the-plan purchases involve buying a property before it's constructed. Buyers enter into a contract based on the plans and specifications provided by the developer. The construction phase typically takes several months to years, and buyers take possession of the property once completed.

Benefits of Off-the-Plan Houses

Off-the-plan houses offer several advantages:

- Potential for growth: The value of your property may increase during the construction phase, offering potential capital gains.

- Customizable options: In some cases, developers may offer buyers the opportunity to customize certain aspects of their home, such as floor plans and finishes.

- Government incentives: First-home buyers may be eligible for government incentives such as the First Home Owner Grant (FHOG), which can assist with purchase costs.

Considerations Before Purchasing

Before making an off-the-plan purchase, it's essential to consider the following:

- Research the developer: Conduct thorough research on the developer's reputation, track record, and financial stability.

- Review the contract carefully: Seek professional legal advice to review the contract and ensure you understand your rights and obligations.

- Consider the location: Evaluate the location of the property and its proximity to amenities, public transport, and job centers.

- Know the estimated completion date: Be aware of the estimated completion date and potential delays that may occur during the construction phase.

Financial Considerations

Purchasing an off-the-plan house requires significant financial planning:

- Deposit: A deposit is typically required to secure the property. The amount varies depending on the developer and the purchase price.

- Progress payments: During the construction phase, buyers may be required to make progress payments as the property nears completion.

- Mortgage: Once the property is completed, buyers will need to secure a mortgage to finance the remaining purchase price.

Protecting Your Investment

To protect your investment in an off-the-plan house, it's important to:

- Obtain a building inspection: Once the property is completed, hire a qualified building inspector to conduct a thorough inspection and identify any potential issues.

- Take out insurance: Ensure your property is adequately insured against events such as damage, theft, or natural disasters.

- Monitor the construction progress: Regularly visit the construction site to monitor the progress and ensure it aligns with the plans and specifications.

Conclusion

Purchasing an off-the-plan house in Sydney can be a rewarding experience. By carefully considering the essential aspects outlined in this article, you can make an informed decision that aligns with your financial goals and lifestyle preferences. Remember to thoroughly research, seek professional advice when needed, and approach the process with a well-informed understanding to ensure a successful outcome.

43 New Townhouse Developments Sydney For In

18 New And Off The Plan Apartments For In Rose Bay Nsw 2029 Domain

43 New Townhouse Developments Sydney For In

Apartments Sydney New Off The Plan For

Buy Off Plan Property Sydney Upstate

Apartments Sydney New Off The Plan For

43 New Townhouse Developments Sydney For In

29 New And Off The Plan Apartments For In Sydney City Nsw Domain

Apartments Sydney New Off The Plan For

Apartments Sydney New Off The Plan For