Essential Aspects of USDA Rural Development Home Plans

The United States Department of Agriculture (USDA) Rural Development program offers various homeownership opportunities for individuals and families in eligible rural areas. These plans are designed to provide affordable housing options while promoting economic development in rural communities.

Here are some essential aspects of USDA Rural Development home plans to consider:

Eligibility Requirements

To qualify for USDA Rural Development home plans, applicants must meet specific income and location requirements. Income limits vary depending on the area and family size. Additionally, the property must be located in a designated rural area as defined by the USDA.

Loan Types

USDA Rural Development offers two main loan types:

*Single-Family Direct Loans:

These loans are provided directly by the USDA and have fixed interest rates. *Guaranteed Loans:

These loans are offered through approved lenders and may have variable interest rates.Property Eligibility

Properties eligible for USDA Rural Development loans must meet certain criteria, including:

* Be located in an eligible rural area. * Be a single-family dwelling. * Be modest in size and value. * Meet health and safety standards.Program Benefits

USDA Rural Development home plans offer numerous benefits, including:

*Low Interest Rates:

Interest rates on USDA loans are typically lower than market rates. *No Down Payment Required:

Some USDA loans allow for 100% financing, eliminating the need for a down payment. *Mortgage Insurance:

USDA loans do not require private mortgage insurance, saving borrowers money on monthly payments. *Closing Cost Assistance:

USDA may provide grants to help cover closing costs associated with purchasing a home.Loan Process

The USDA Rural Development loan process typically involves:

* Completing an application and providing financial documentation. * Obtaining property approval, including a home inspection. * Finalizing loan approval and closing on the property.Additional Considerations

When considering USDA Rural Development home plans, it's important to note:

*Income Limits:

Income limits can vary significantly depending on the area and family size, so it's crucial to check eligibility requirements thoroughly. *Location Restrictions:

Properties must be located in designated rural areas as determined by the USDA. *Property Value Limits:

Eligible properties must meet specific value limits to qualify for USDA loans. *Repayment Terms:

USDA loans typically have fixed repayment terms ranging from 30 to 38 years.If you're considering purchasing a home in a rural area, USDA Rural Development home plans can provide affordable options with low interest rates and various benefits. However, it's essential to carefully consider the eligibility requirements, property criteria, and loan process to ensure these plans meet your needs and financial situation.

Usda Rural Development Home Homes In Partnership Inc

Intro To Usda Rural Development Home Loans Fifth Third Bank

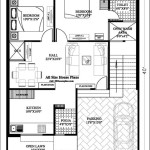

1800 Sq Ft Country Ranch House Plan 3 Bed Bath 141 1175

Plan 60102 One Story Country Living House

Usda Home Loans Greater Nevada Mortgage

Iowa Usda Rural Development Loan Rmn

House Plan 59163 Southern Style With 600 Sq Ft 1 Bed Bath

Plan 60112 Small Cabin Home With 872 Sq Ft 1 Bed And 2 Ba

What Is A Usda Loan Forbes Advisor

House Plan 59139 Traditional Style With 2000 Sq Ft 3 Bed 2 Ba